Commercial Insights

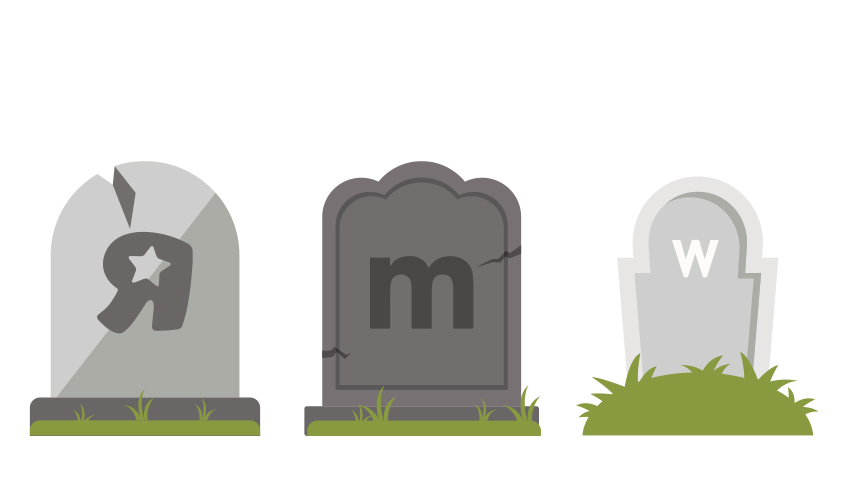

Our high streets have taken a hit in recent years, but the start of 2018 has been particularly poor for retail. As big names such as Toys R Us, Maplin, and Claire's Accessories face bankruptcy, we take a look at the reasons behind this.

Woolworths was an American retailer that, over the course of a century, became a British high-street staple. For years, it was the main purveyor of Christmas presents for children, while their parents browsed everything from DVDs to garden furniture. As music evolved from vinyl records to CDs, Woolworths evolved along with it. If nothing else, it kept the nation in good supply of pick n mix sweets.

Yet Woolworths – affectionately branded “Woolies” by the British public and media – entered administration on 29 January 2009, taking 27,000 jobs with it. After moving some of its multi-storey shops into smaller outlets from the 1980s to early 2000s, and splitting from its American parent company, Woolworths started to feel the pressure. Physical music died out, competitors sprung up in the forms of Wiko and Argos, and when the financial crisis hit in 2008, it was the last straw for Woolies.

Yet 100 former Woolworths stores were still empty three years after the brand announced it was going into liquidation, with no alternative renters taking on the spaces – an indicator of the dire state of the British high street.

Bidding farewell to Toys R Us

More than a decade after Woolworths ceased to feature on high streets across the country, a number of big names in retail are following suit. Toys R Us went into administration at the end of February this year, buckling under the weight of a £15m tax bill in parallel with the company’s bankruptcy in the USA. Known for its large out-of-town branches, and historically for identifying and selling cult toys around holiday periods, Toys R Us eventually closed its UK stores in mid-April.

It’s not just toys that will no longer be available in the UK’s cavernous retail-park outlets – Maplin, an electronic goods retailer, will eventually close its doors too, meaning 5,500 job losses. While the company has gone into administration, staff do not yet know when the stores will be closed for good.

Moorfields Advisory is overseeing the liquidation of Toys R Us. Simon Thomas is the Joint Administrator and Partner at Moorfields. Commenting on the liquidation, he said: “We have made every effort to secure a buyer for all or part of the Company’s business. This process attracted some interest, but ultimately no party has been able to move forward with a formal bid prior to the expiration of the stated deadline.

“It is therefore with great regret that we have made the difficult decision to make a number of positions redundant at the Company’s head office in Maidenhead and proceed with a controlled store closure programme. We are grateful for the hard work of Toys R Us staff during this very difficult period and will be providing support where we can to those who have been made redundant.”

Why is this happening?

All of these brands found their prices undercut by online retailers such as Amazon, and with next-day delivery and collection services, their out-of-town locations and sprawling store formats were rendered clunky and inconvenient by consumers. Meanwhile, high-street rent prices soared, creating an expense which storeless retailers, such as ASOS, were able to swiftly avoid, investing their profits elsewhere.

As consumer habits have changed, businesses that did not change with them have been dwarfed by the capabilities of e-commerce. It’s a way of shopping that has taken over the world – in 2017, worldwide retail e-commerce sales were at 2.3 trillion US dollars, a figure that is predicted to rise to 4.88 trillion USD by 2021.

These figures demonstrate that consumers have moved away from devoting time and effort to visiting shops, in favour of a speedier way of shopping. Large, warehouse-style shops such as Toys R Us are messy, hard to navigate, and generate a long process rather than a short, stress-free one.

In addition to the sleek, time-saving aspects of online retailers, competition is building in the form of consumer-led trading sites such as eBay. With new or barely used toys being auctioned off for the fraction of their retail price on eBay, and Amazon making enough profit to undercut the recommended retail prices, there leaves no room for the likes of Toys R Us. The model expands beyond just toys, extending to everything including furniture, electronics and specialist items.

Yet the death of retail is more than just a nostalgic end of highstreets peppered with Woolworths and New Look - which also ran into difficulties and faced store closures earlier this year - or for the days of piling into the family car to head to an out-of-town retail park. The efficient model used by Amazon cuts out the need for a large human workforce – so the job losses that come with the closures of Toys R Us, New Look and Maplin will not be compensated with alternatives in e-commerce.

Online stores just don’t employ as many people as physical stores do – which poses a genuine risk to the communities in which retail is a viable job option. 15.2% of the population was employed in retail in 2016 – making it the largest industry in Britain. Each time a brand on the scale of Toys R Us goes into liquidation, this figure depletes in the thousands.

Cultural implications

So, why exactly has the high street lost its place as a cultural norm in our society? For a lot of people, it boils down to economic strife, and the long-term decline of small and medium towns featuring high-streets. While cities tend to offer higher wages, and can therefore sustain more shopping opportunities, smaller towns with less enticing job prospects do not offer local residents the same disposable income. These populations don’t have the money to visit the high street, or to run cars to out-of-town retail parks. Where they do have the money, fast-paced schedules mean that they simply don’t have the time.

While we may mourn the high street as more and more shops close their doors for good, it’s worth noting that it’s not a problem unique to the UK. Toys R Us had already filed for bankruptcy in the US months before the UK subsidiary made the same descent. With a series former retail giants disappearing from the US, it’s clear that the UK’s high streets aren’t the only ones seeing losses.

In the weeks before Christmas last year, Amazon made a strategic and ironic move, opening a pop-up store in Soho Square, London. It disappeared a few short weeks later, confirming that rather than expanding its reach into physical shop fronts, Amazon was most likely engaging with the novelty of pushing its online brand into a “real-life” context. With this in mind, could it be that the high-street has become nothing more than a novelty in a world spun by e-commerce?

Academy tools to help you get a job

-

Free Watson Glaser Practice Test

Understand the test format, compare your performance with others, and boost your critical thinking skills.